In an era where companies are scaling faster than ever and data moves in real time, one thing hasn’t evolved fast enough in many organizations: the FP&A process.

Finance leaders are expected to be strategic partners, not spreadsheet firefighters. Yet most teams are still operating with legacy habits, reactive cadence, and siloed data — unintentionally slowing down decisions, innovation, and growth.

If your business feels like it’s always catching up instead of leading the curve, your FP&A engine may be the bottleneck.

Here are five warning signs your FP&A process is holding you back — and what to do about it.

1. You Spend More Time Collecting Data Than Analyzing It

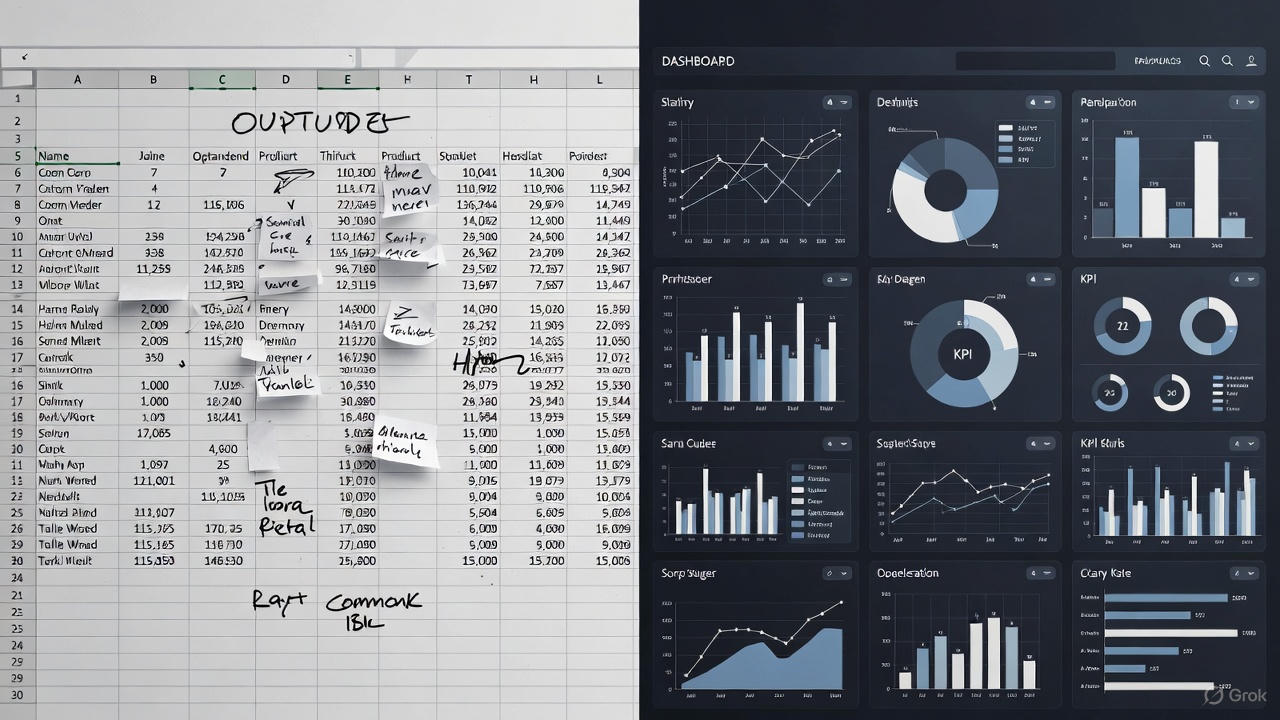

If your team is spending days chasing spreadsheets, wrangling CSVs, and emailing budget templates back and forth — you’re not running FP&A. You’re running data janitorial services.

🚨 Symptom

- Manual Excel pipelines feeding dozens of versions

- Finance scrambling for data at month-end

- Analysts spending 70% of their time on admin, not insight

💡 Why It Hurts

Slow consolidation = slow decisions.

By the time you finish reporting, the business has already moved.

⚙️ Fix: Modernize your data flow

- Centralize source systems

- Adopt Power BI, Snowflake, or a modern data warehouse

- Automate data collection with Power Automate / API pipelines

Insight is your value — data cleanup isn’t.

2. Forecasts Are Built Once, Then Forgotten

Traditional FP&A treats forecasting like an annual ritual.

Modern finance treats forecasting like a living, breathing system.

🚨 Symptom

- Annual budget becomes obsolete by Q2

- Zero scenario flexibility

- Decision makers forced to operate on stale data

💡 Why It Hurts

Static plans can’t keep up with volatile markets, shifting supply chains, and evolving customer behavior.

⚙️ Fix: Move to continuous planning

- Monthly or rolling forecasts

- What-if scenario modeling for market, price, and volume shifts

- Dynamic drivers tied to real-time business activity

If your forecast doesn’t change with your reality, it’s not a forecast — it’s a guess.

3. Your Metrics Are Looking Backward, Not Forward

Reporting what happened is table stakes.

Predicting what comes next? That’s competitive advantage.

🚨 Symptom

- Heavy reliance on historical data

- No predictive analytics or forward-looking KPIs

- Finance acting as scorekeeper, not strategist

💡 Why It Hurts

Reactive insights slow decision cycles and limit innovation.

⚙️ Fix: Build predictive intelligence

- Power BI + AI insights

- Driver-based forecasting

- Leading KPIs (pipeline-to-sales conversion, churn predictors, capacity bottlenecks)

Your business shouldn’t have to guess the future — you should model it.

4. The Business Doesn’t Trust the Numbers

When stakeholders feel finance operates in a black box, they start building parallel spreadsheets and rogue metrics.

🚨 Symptom

- Duplicate models created by Sales, Ops, or Product

- Arguments over “which number is right”

- Delays in decision making because data isn’t aligned

💡 Why It Hurts

Lack of trust = lack of alignment, silos, and lost velocity.

⚙️ Fix: Democratize data

- Self-service dashboards

- One source of truth

- Transparent definitions and governance

Finance should be the enabler of clarity, not the bottleneck of transparency.

5. Your FP&A Cycle Drains Energy Instead of Fueling Strategy

If budgeting feels like a painful corporate ritual instead of a strategic growth engine — something is broken.

🚨 Symptom

- Exhaustive manual budgeting cycles

- Finance drowning in revisions and email threads

- Business leaders viewing planning as a chore, not collaboration

💡 Why It Hurts

Slow planning = slow pivoting.

And today’s winners are the fastest learners.

⚙️ Fix: Redesign the FP&A experience

- Streamlined workflows using automation tools

- Clear planning calendar and accountability

- Integrated budgeting with operational systems (ERP, CRM, HRIS)

- Collaborative dashboards replacing spreadsheets

A modern FP&A model should feel like a GPS for growth, not paperwork.

The Bottom Line

Markets evolve fast. Competitive landscapes shift overnight.

If your FP&A processes are rigid, manual, or rear-view-mirror-focused, growth will stall — even if demand doesn’t.

The best finance teams today aren’t just reporting numbers…

They’re running real-time financial engines powered by automation, analytics, and business partnership.

🚀 Modern FP&A is:

✅ Digital

✅ Continuous

✅ Predictive

✅ Collaborative

✅ Strategic And it doesn’t require a massive transformation budget —

just a mindset shift and the right technology approach.

Ready to Modernize Your FP&A Engine?

At Finentis, we help finance teams transform from manual and reactive to automated, analytical, and strategic using:

- Power BI & advanced analytics

- Power Automate workflows

- FP&A roadmap & operating model design

- Self-service reporting systems

- Scenario planning & forecasting frameworks

Let’s design the finance function of the future — today.

🗓️ Book a strategy call

📘 Download the Finance Automation Starter Kit